Table of Content

Get all your paperwork in order so you can speed up the process before you apply for a loan. Let’s go over the documentation you’ll usually need when you apply for a mortgage. Visit Rocket HomesSM to get a proven real estate agent that’s handpicked just for you. That means working with a lender to get the best possible loan.

There is quite a bit to know about financing the purchase of a home. There are several things to consider when it comes to getting a mortgage. Stilt, Inc strives to keep this blog information accurate and up to date. We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible. One of your goals might be to build your emergency savings so that you can be prepared for the unexpected in the future.

VA loans

You’ll also want to consider the personal risk you’re taking on when getting a mortgage without a job. Defaulting on a mortgage can have a long-term negative impact on your credit history and may cause other difficulties in your life. The Federal Housing Administration insures loans with more flexibility for credit and DTI. It also allows for nontraditional credit histories, although the requirements are slightly different than conventional mortgages.

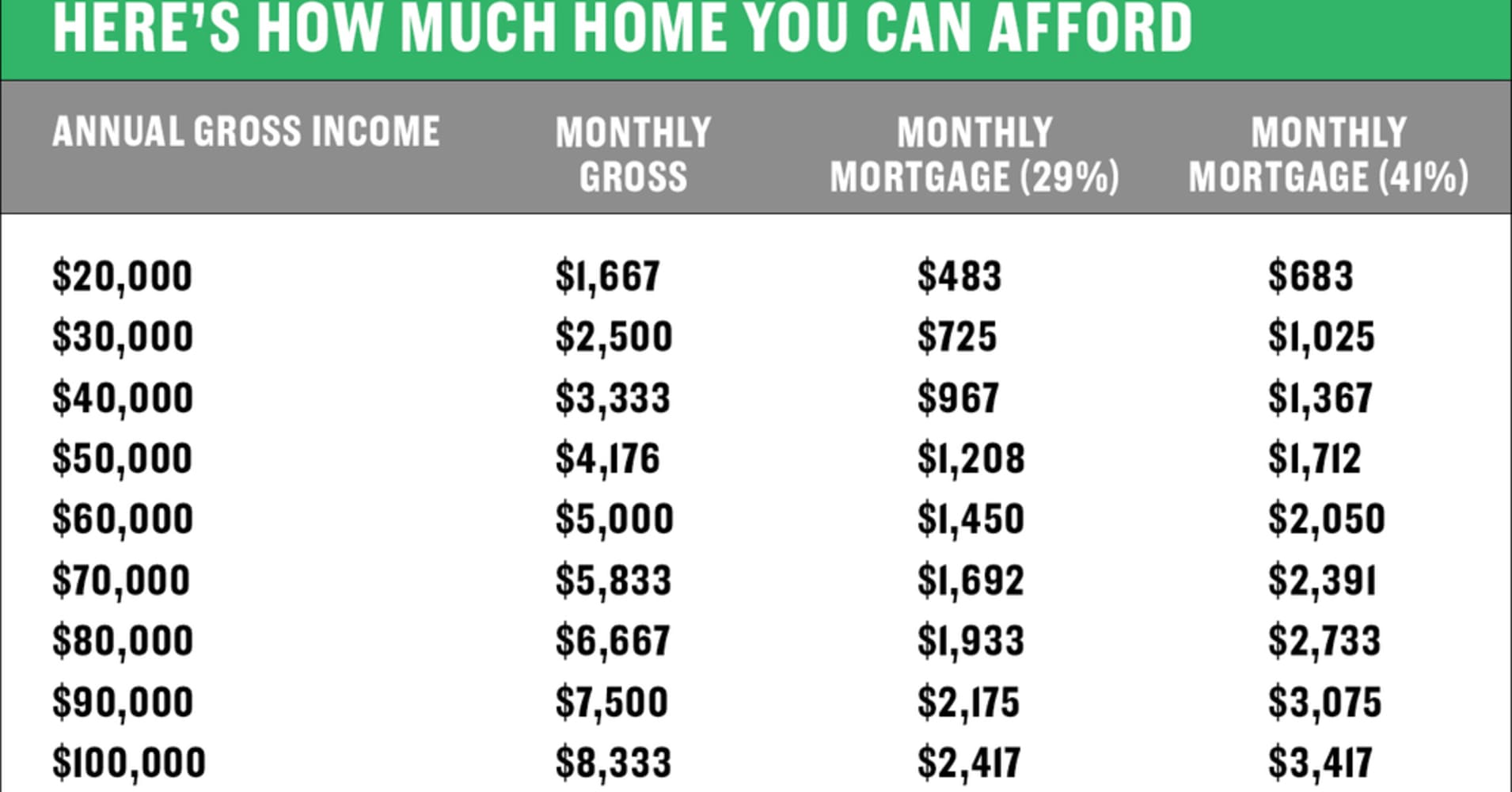

It is important to note that you may need a co-signer in order to be approved for a loan, and the interest rates may be higher than average. Applying for a mortgage with your spouse now qualifies you for a mortgage payment up to $2,400 a month, or a home purchase up to $475,000. Your mortgage payment cannot exceed 28 percent to 31 percent of your gross monthly income. With medical accounts, credit bureaus must remove paid accounts from your credit report within 45 days. Negotiate with these collection agencies in writing and wait for a signed agreement before paying the account.

FHA Title II manufactured home loans

There is no set dollar amount that you need to earn each year to be able to buy a home. However, your mortgage lender does need to know that you have a steady cash flow to pay back your loan. Your interest rate, homeowners insurance, property taxes, and homeowners association fees also affect how big a mortgage you can take out. If you're in the market to buy a home, too, you might wonder how much you can get preapproved for, especially given how fast home prices have been rising.

There is also a growing movement of financial advisors who advise against using credit at all. Check your buying power by getting pre-qualified for a mortgage with us at Zillow Home Loans. These homes can still be financed, just not with home mortgages. Low-income home buyers (who earn 80% or less of their area’s median income) can get loans directly from the USDA. The FHA can also help you buy the plot of land for your new manufactured home through a process that resembles a construction loan.

Your debt and income help decide how much you may qualify for

On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more. If you are considering applying for a personal loan, just follow these 3 simple steps. Let’s look at a few ways in which you can still prove your financial wellbeing. You could still qualify for an undocumented immigrant home loan.

Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Your pre-qualification and pre-approval are based on your current employment and your financial lifestyle over the past two years. Making any sudden changes in employment can affect whether or not you qualify for a loan. If that’s the case, speak with your lender about it to determine the next steps.

What To Do With Old Collections

Before closing, it is vital not to make a large purchase, such as a car. Your credit and bank accounts should be stable without significant additions or subtractions. It is worthwhile to educate yourself on things to know about credit scores. Mortgage prequalification and mortgage preapproval are two essential processes that potential homebuyers typically engage in before making an offer on a property. Despite their similarities, these two procedures do differ from one another.

As a result, however, you’ll pay a higher interest rate, especially with damaged credit. Securing your loan with an asset, such as a bank account or vehicle, can lower your rate. Most lenders require a score of at least 680 in order to get approved for a home equity loan.

You'll also need documents showing any other forms of income, such as child support or Social Security income. A payment-option ARM lets you choose from different ways to repay your loan, one of which is a minimum payment option. You might see a really low interest rate for the beginning of the loan term, and that’s what your payments will be based on. The minimum credit score to get a mortgage depends on which type of mortgageyou’re applying for.

Most manufactured homes, especially double-wide or modular homes, easily meet this requirement. A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. For people without a mortgage, you have a 0% CLTV, which means you definitely meet the CLTV requirement for a home equity loan. If you’re uncertain how much money you need to borrow, a home equity line of credit might be a better option. Bill Gassett is a thirty-six year veteran to the real estate industry. He enjoys writing helpful articles for buyers, sellers and fellow real estate agents to make sound decisions.

While they may not require you to pay, it is best to establish a repayment plan with the creditor or work through relief such as debt settlement. But the effect that collections have on your credit score diminishes over time. When you start paying off these old debts, you bring the account to the forefront again. Tax liens and judgments are two items that must be satisfied before you can be approved to close on your home loan.

Until you have 60 to 90 days of activity on any type of credit account, it’s unlikely that you’ll have a credit score. Even if you have reversed the downward spiral of your credit history, you might need to tell a prospective lender that there may be some signs of bad credit in your report. This will save you time, since he or she will look at different loans than he might otherwise. If you have bad credit and fear you’ll face a loan denial when applying for a mortgage, don’t worry. You may still be able to get a mortgage with a low credit score. Of course it will depend on a few factors, so your best bet to see if you’ll qualify for a loan is to talk to a lender.

No comments:

Post a Comment